Home » Course Layouts » Free Course Layout Udemy

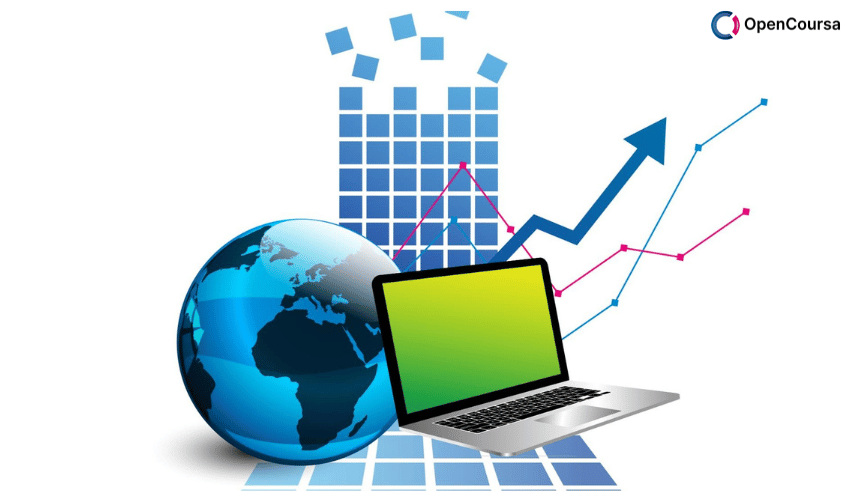

Econometric Modelling. Instructor: Prof. Rudra P. Pradhan, Department of Management, IIT Kharagpur.

0

English

English [CC]

FREE

- Learn basic syntax that can apply to any language.

- Learn what is a programming language and the basic concepts for beginners.

- Understand what is Javascript in it's truest form.

- Know the basic syntax of Javascript.

- Know some hidden quirks in Javascript.

Description

The objective of this course is to present a comprehensive tools and techniques for managerial decision making including problem of cost estimation, market size determination, sales projection, stock price prediction, etc. It has two parts. First part deals with regression-based modeling, which captures the behavior of variable through a structural model based on theory. The second part deals with time series modeling, which concentrates on the dynamic characteristics of economic and financial data. (from nptel.ac.in)

Course content

- Lecture 01 – Introduction Unlimited

- Lecture 02 – Structure of Econometric Modelling Unlimited

- Lecture 03 – Univariate Econometric Modelling Unlimited

- Lecture 04 – Bivariate Econometric Modelling Unlimited

- Lecture 05 – Bivariate Econometric Modelling (cont.) Unlimited

- Lecture 06 – Probability Unlimited

- Lecture 07 – Bivariate Econometric Modelling Unlimited

- Lecture 08 – Bivariate Econometric Modelling (cont.) Unlimited

- Lecture 09 – Reliability of Bivariate Econometric Modelling Unlimited

- Lecture 10 – Reliability of Bivariate Econometric Modelling (cont.) Unlimited

- Lecture 11 – Reliability of Bivariate Econometric Modelling (cont.) Unlimited

- Lecture 12 – ANOVA for Bivariate Econometric Modelling Unlimited

- Lecture 13 – Trivariate Econometric Modelling Unlimited

- Lecture 14 – Trivariate Econometric Modelling (cont.) Unlimited

- Lecture 15 – Reliability of Trivariate Econometric Modelling Unlimited

- Lecture 15 – Reliability of Trivariate Econometric Modelling Unlimited

- Lecture 16 – Multivariate Econometric Modelling Unlimited

- Lecture 17 – Multivariate Econometric Modelling (cont.) Unlimited

- Lecture 18 – Matrix Approach to Econometric Modelling Unlimited

- Lecture 19 – Matrix Approach to Econometric Modelling (cont.) Unlimited

- Lecture 20 – Multicollinearity Problem Unlimited

- Lecture 21 – Multicollinearity Problem (cont.) Unlimited

- Lecture 22 – Autocorrelation Problem Unlimited

- Lecture 23 – Autocorrelation Problem (cont.) Unlimited

- Lecture 24 – Heteroscedasticity Problem Unlimited

- Lecture 25 – Heteroscedasticity Problem (cont.) Unlimited

- Lecture 26 – Dummy Modelling Unlimited

- Lecture 27 – Dummy Modelling (cont.) Unlimited

- Lecture 28 – Logit and Probit Model Unlimited

- Lecture 29 – Logit and Probit Model (cont.) Unlimited

- Lecture 30 – Panel Data Modelling Unlimited

- Lecture 31 – Panel Data Modelling (cont.) Unlimited

- Lecture 32 – Simultaneous Equation Modelling Unlimited

- Lecture 33 – Simultaneous Equation Modelling (cont.) Unlimited

- Lecture 34 – Structural Equation Modelling Unlimited

- Lecture 35 – Structural Equation Modelling (cont.) Unlimited

- Lecture 36 – Time Series Modelling Unlimited

- Lecture 37 – Time Series Modelling (cont.) Unlimited

- Lecture 38 – Unit Root Unlimited

- Lecture 39 – Cointegration Unlimited

- Lecture 40 – Concluding Remarks Unlimited

N.A

- 5 stars0

- 4 stars0

- 3 stars0

- 2 stars0

- 1 stars0

No Reviews found for this course.

Instructor

OpenCoursa

Accessible Education for Everyone

5

5

6

24772

4637

We are an educational and skills marketplace to accommodate the needs of skills enhancement and free equal education across the globe to the millions. We are bringing courses and trainings every single day for our users. We welcome everyone woth all ages, all background to learn. There is so much available to learn and deliver to the people.

Explore Free Courses

Access valuable knowledge without any cost.

{"title":"","show_title":"0","post_type":"course","taxonomy":"course-cat","term":"engineering-skills,health-and-safety","post_ids":"","course_style":"free","featured_style":"course6","masonry":"","grid_columns":"clear4 col-md-3","column_width":"268","gutter":"30","grid_number":"4","infinite":"","pagination":"","grid_excerpt_length":"20","grid_link":"1","grid_search":"0","course_type":"","css_class":"","container_css":"","custom_css":""}