Home » Course Layouts » Free Course Layout Udemy

Aside from tax fraud, insurance fraud is the most practised fraud in the world. The insurance business, by its very nature, is susceptible to fraud. Insurance is a risk distribution system that requires the accumulation of liquid assets in the form of reserve funds that are, in turn, available to pay loss claims. Insurance companies generate a large, steady flow of cash through insurance premiums. Steady cash flow is an important economic resource that is attractive and easily diverted.

0

30

English

English [CC]

- Learn basic syntax that can apply to any language.

- Learn what is a programming language and the basic concepts for beginners.

- Understand what is Javascript in it's truest form.

- Know the basic syntax of Javascript.

- Know some hidden quirks in Javascript.

Description

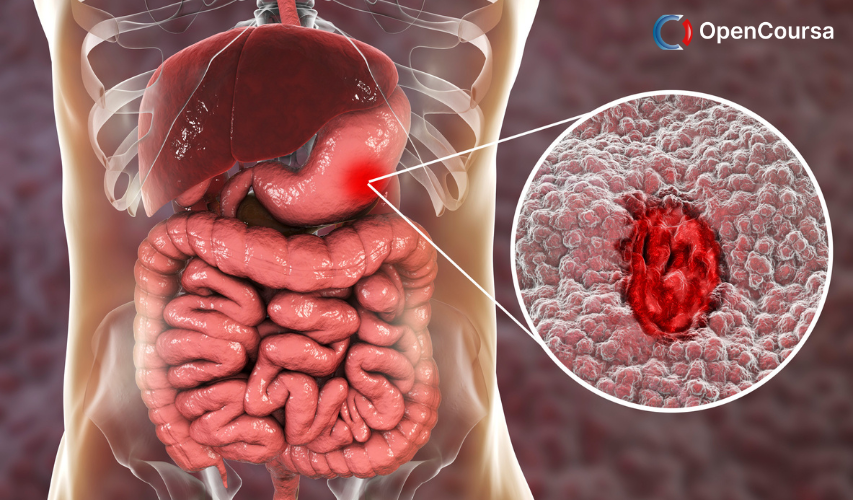

To conquer insurance fraud, one must first know what insurance is. In basic terms, it is a contract between an insurer and an insured. In a contract, the insurer indemnifies the insured against losses, damages, or liability from an unknown event. A preexisting condition must not exist for insurance to be valid. For example, obtaining automobile insurance after an accident is not insurance and does not indemnify the insured for any injuries suffered. Insurance fraud exists when individuals attempt to profit by failing to comply with the terms of the insurance agreement. Perpetrators of insurance fraud try to create losses or damage rather than joining others who have no losses but wish to keep themselves protected in case an unknown event should occur.

Insurance fraud has existed since the beginning of insurance as a commercial enterprise. Fraudulent claims account for a significant portion of all claims received by insurers and cost billions of dollars annually. Types of insurance fraud are diverse and occur in all areas of insurance. Insurance crimes also range in severity, from slightly exaggerating claims to deliberately causing accidents or damage. Fraudulent activities affect the lives of innocent people, both directly through accidental or intentional injury or damage, and indirectly as these crimes cause insurance premiums to be higher. Insurance fraud poses a significant problem, and governments and other organizations make efforts to deter such activities.

Course Content

- Insurance Fraud Overview

- Establishing and Measuring A New Special Investigation Unit

- The Policy and the Contract

- Conducting Examination Under the Oath

- The Insurance Interview Process

- Information Gathering and Legal way of Sharing

- Conducting Surveillance

- Expert Selection Process

Course content

-

- Insurance Fraud Overview 03:00:00

-

- Establishing and Measuring A New Special Investigation Unit 04:00:00

- The Policy and the Contract 04:00:00

- The Insurance Interview Process 03:00:00

- Conducting Surveillance 02:00:00

- Assignments and Presentation 6 months

- Insurance Fraud Assignment 28, 00:00

N.A

- 5 stars0

- 4 stars0

- 3 stars0

- 2 stars0

- 1 stars0

No Reviews found for this course.

Instructor

OpenCoursa

Accessible Education for Everyone

5

5

6

24760

4637

We are an educational and skills marketplace to accommodate the needs of skills enhancement and free equal education across the globe to the millions. We are bringing courses and trainings every single day for our users. We welcome everyone woth all ages, all background to learn. There is so much available to learn and deliver to the people.

Explore Free Courses

Access valuable knowledge without any cost.

{"title":"","show_title":"0","post_type":"course","taxonomy":"course-cat","term":"engineering-skills,health-and-safety","post_ids":"","course_style":"free","featured_style":"course6","masonry":"","grid_columns":"clear4 col-md-3","column_width":"268","gutter":"30","grid_number":"4","infinite":"","pagination":"","grid_excerpt_length":"20","grid_link":"1","grid_search":"0","course_type":"","css_class":"","container_css":"","custom_css":""}