Home » Course Layouts » Free Course Layout Udemy

Going public refers to a private company's initial public offering (IPO), thus becoming a publicly-traded and owned entity. Businesses usually go public to raise capital in hopes of expanding. Additionally, venture capitalists may use IPOs as an exit strategy (a way of getting out of their investment in a company).

0

30

English

English [CC]

- Learn basic syntax that can apply to any language.

- Learn what is a programming language and the basic concepts for beginners.

- Understand what is Javascript in it's truest form.

- Know the basic syntax of Javascript.

- Know some hidden quirks in Javascript.

Description

Overview

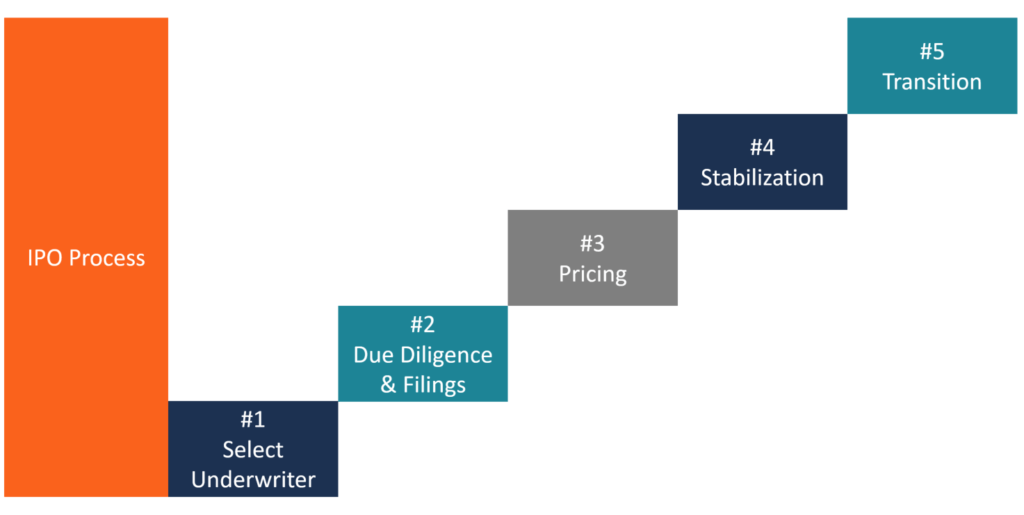

This training program is designed to make the learner understand the process of getting public. The IPO process begins with contacting an investment bank and making certain decisions, such as the number and price of the shares that will be issued. Investment banks take on the task of underwriting, or becoming owners of the shares and assuming legal responsibility for them. The goal of the underwriter is to sell the shares to the public for more than what was paid to the original owners of the company. Deals between investment banks and issuing companies can be valued at hundreds of millions of dollars, some even hitting $1 billion or more.Requirements for Listing

For some entrepreneurs, taking a company public is the ultimate dream and mark of success, one that is accompanied by a large payout. However, before an IPO can even be discussed, a company must meet requirements laid out by the underwriters.

- The company has a predictable and consistent revenue. Public markets do not like it when a company misses earnings or has trouble predicting what they will be. The business needs to be mature enough that it can reliably predict the next quarter and the next year's expected earnings.

- There is extra cash to fund the IPO process. It is not cheap to go public, and many expenses start occurring long before the IPO. The funds raised from going public can't necessarily be used to pay for those costs.

- There is still plenty of growth potential in the business sector. The market does not want to invest in a company with no growth prospects; it wants a company with reliable earnings today, but one that also has lots of proven room to grow in the future.

- The company should be one of the top players in the industry. When investors are looking at buying in, they will compare it to the other companies in the space.

- There should be a strong management team in place.

- Audited financials are a requirement for public companies.

- There should be strong business processes in place. This one is valuable even if a company stays private, but going public means each aspect of how the company is run will be critiqued.

- The debt-to-equity ratio should below. This ratio can be one of the biggest factors in derailing a successful IPO. With a highly leveraged company, it is hard to get a good initial price for the stock, and the company may encounter stock sales problems.

- The company has a long-term business plan with financials spelt out for the next three to five years to help the market see that the company knows where it's going.

Learning Objectives

- Acquire an overview of the IPO process from conception to closing the offering

- Be able to construct a plan to undertake the execution of an offering.

- Prepare to address legal, accounting and reporting issues which may be encountered.

- Analyze the various regulatory bodies involved in a public offering and learn to effectively assist the IPO team in dealing with these bodies.

Course content

-

- Preliminary Considerations (IPO) 02:00:00

-

- Preparing for the IPO 02:00:00

- Registering the IPO 02:00:00

- Course Summary (IPO) 00:20:00

- The Survival Guid to IOPs 04:10:00

- Prospectus (IPO) 04:10:00

- Officer & Director Questionnaire (IPO) 02:30:00

N.A

- 5 stars0

- 4 stars0

- 3 stars0

- 2 stars0

- 1 stars0

No Reviews found for this course.

Instructor

OpenCoursa

Accessible Education for Everyone

5

5

6

24772

4637

We are an educational and skills marketplace to accommodate the needs of skills enhancement and free equal education across the globe to the millions. We are bringing courses and trainings every single day for our users. We welcome everyone woth all ages, all background to learn. There is so much available to learn and deliver to the people.

Explore Free Courses

Access valuable knowledge without any cost.

{"title":"","show_title":"0","post_type":"course","taxonomy":"course-cat","term":"engineering-skills,health-and-safety","post_ids":"","course_style":"free","featured_style":"course6","masonry":"","grid_columns":"clear4 col-md-3","column_width":"268","gutter":"30","grid_number":"4","infinite":"","pagination":"","grid_excerpt_length":"20","grid_link":"1","grid_search":"0","course_type":"","css_class":"","container_css":"","custom_css":""}